puerto rico tax incentive program

Fixed income tax rate of between 4 and 10 100 exemption on. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not.

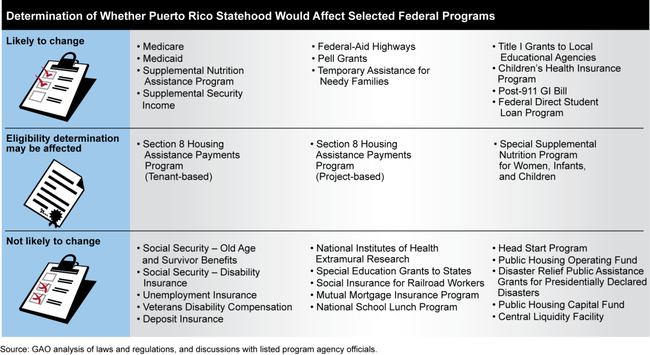

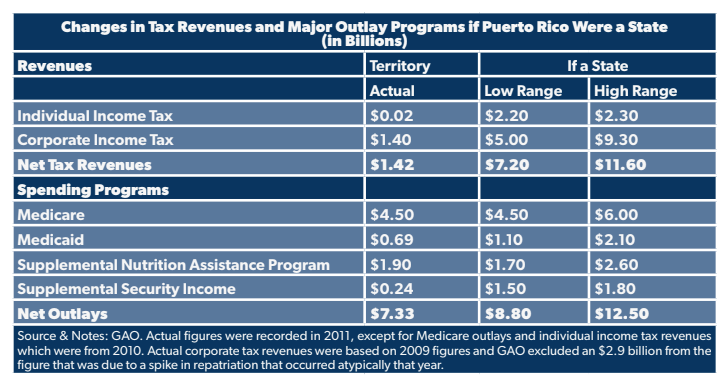

Puerto Rico Information On How Statehood Would Potentially Affect Selected Federal Programs And Revenue Sources U S Gao

Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico.

. The Islands incentive package for the tourism and hospitality industry is equally enticing. Puerto Rico offers several Acts that provide tax and business incentives to qualifying business operations that decide to establish in Puerto Rico. In addition some of the tax incentives have been added and others have been amended.

The regulations do enable taxpayers to exclude some portion of taxable gain attributable to appreciation occurring during their residence in Puerto Rico Regs. Major changes were made to Act 20 and Act 22 on July 11 2017 the most popular of Puerto Ricos tax incentives. The credit will range from 5 to 125 of the gross earned income subject to limitations depending on the amount of dependants claimed by the taxpayer.

The new law does NOT eliminate the existing incentives. The Department of Economic Development and Commerce DDEC implemented the Incentive for Creative Industries whose assigned amount amounts to 3 million for entities and individuals who work on their own in said sector in order to provide an economic reinforcement. Incentives Eligible Businesses Financial Report Energy Bill Credit Documents Please Read.

Production Incentives 40 Production tax credit on all payments to Puerto Rico Resident companies and individuals 20 Production tax credit on all payments to Qualified Nonresident individuals Persons engaged in qualifying film projects are eligible for the following preferential tax rates and exemptions. Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for the privilege of getting lower taxes. Taxes generally apply to income and appreciation occurring after establishing residence in PuertoRico.

You can access the Puerto Rico Tourism Companys Virtual Clerk to request incentives. The findings were the following. The new law does NOT eliminate the existing incentives.

In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. Export Services Tax Incentive For Businesses Business owners who establish a qualifying business in Puerto Rico can enjoy significant tax benefits. Below is an updated review of Puerto Ricos tax incentives for 2017.

For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the EIC. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect. Remember that residents dont pay US.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Qualifying industries such as scientific research and development manufacturing operations recycling businesses high technology film agriculture hospital facilities hotels and related tourist. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Puerto Rico officially the Commonwealth of Puerto Rico is a self- governing a territory of the United States located in the northeastern Caribbean east of the Dominican Republic and west of both the US Virgin Islands and the British Virgin Islands. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Read our extensive list of Puerto Rico tax incentives to determine which is right for you.

Benefits of establishing relocating or expanding businesses in Puerto Rico. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years. Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico.

Puerto Rico has created an aggressive tax incentive program to connect with the global. Just about any portable online or service business can qualify. Make Puerto Rico Your New Home.

Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world. Puerto Rico requires to invest in competitive activities of high economic value and positive performance. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US.

In 2017 the Economic Development Department conducted a study to evaluate the cost and performance of the economic incentives granted. The Puerto Rican tax incentives and the exemption from US. The existence of 58 incentive laws or programs to promote economic activities.

Tax and incentives guide. The Act 20 tax incentive is for businesses providing a service from Puerto Rico to companies or persons outside of Puerto Rico. COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY Income Tax Return for Exempt Businesses Under the Puerto Rico Incentives Programs Part I TAXABLE YEAR BEGINNING ON _____ ____ AND ENDING ON _____ _____ Payment Stamp Contracts with Governmental Entities Yes No CHANGE OF ADDRESS Yes No 2000 RETURN Spanish English.

Puerto Rico Tax Incentives Professional Physicians Formerly Act 14 Professional Researchers or Scientists Formerly Act 14 Professional of Difficult Recruitment Formerly Act 14 Export Services Formerly Act 20 Export Trade and Hubs Formerly Act 20. Also during the year 2012 two additional laws were enacted. 4 corporate tax rate 100 tax exemption on distributions from earnings and profits 50 tax exemption on municipal taxes.

Cdbg Dr Gap To Low Income Housing Tax Credits Program Lihtc Cdbg

Key Tax Credits Available On The 2021 Puerto Rico Individual Income Tax Return Kevane Grant Thornton

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Child Tax Credit Now Available To Puerto Rico Puerto Rico Report

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

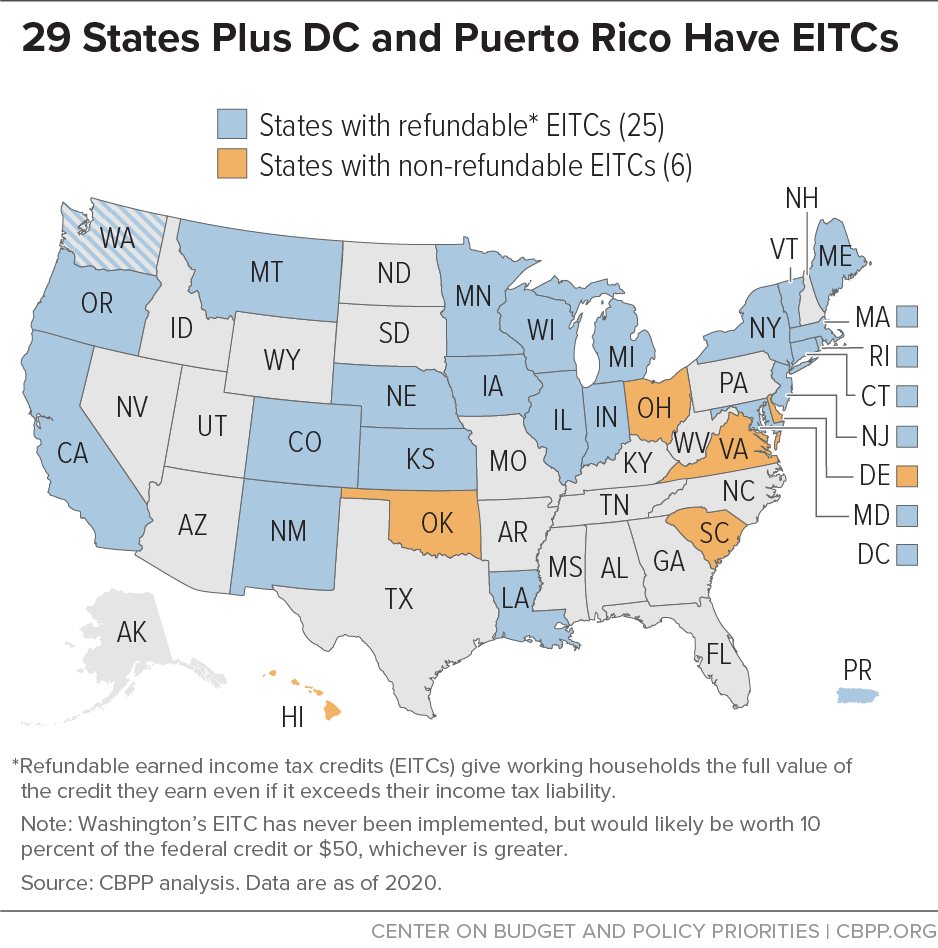

29 States Plus Dc And Puerto Rico Have Eitcs Center On Budget And Policy Priorities

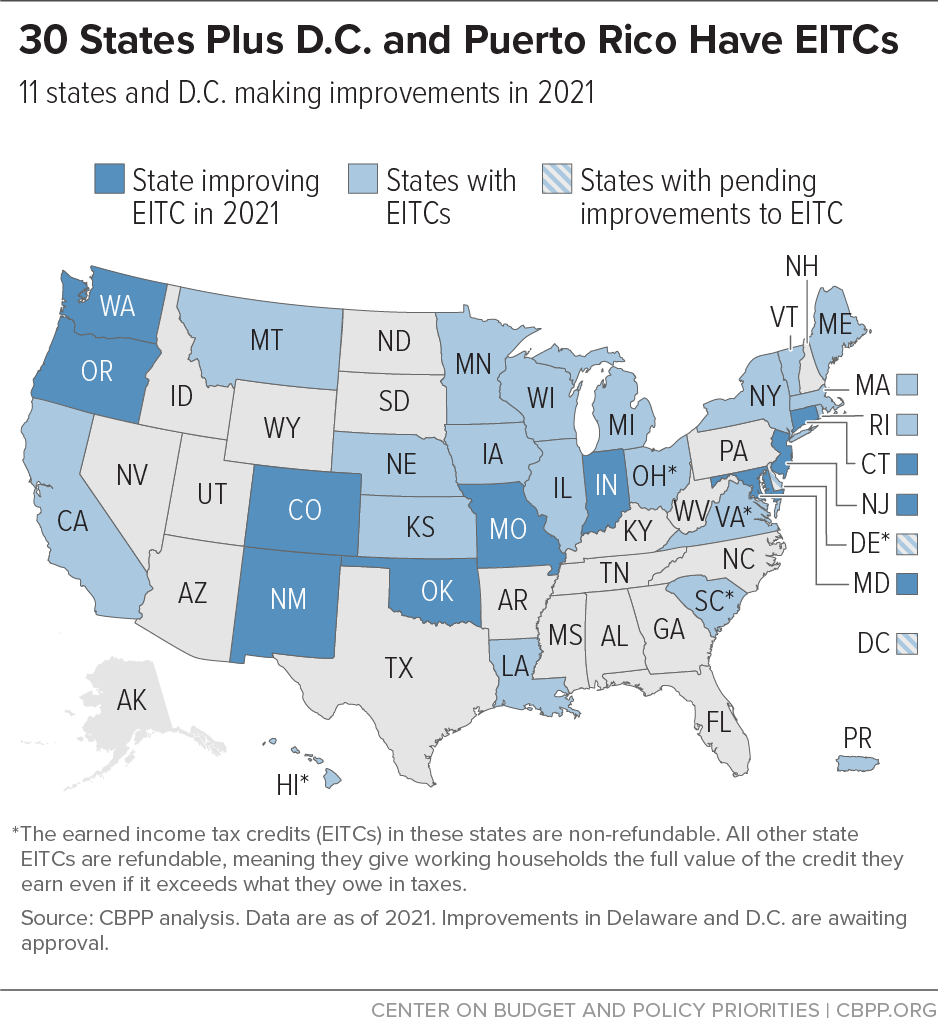

30 States Plus D C And Puerto Rico Have Eitcs Center On Budget And Policy Priorities

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

The Puerto Rico Tax Haven Will Act 20 Work For You

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

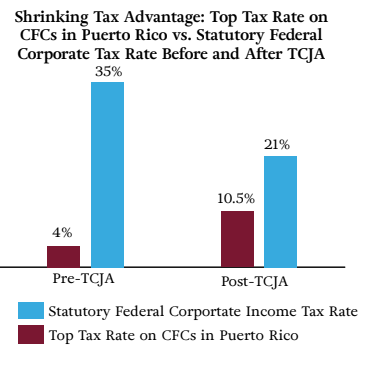

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Puerto Rico Income Tax Withheld On Salaries Torres Cpa

Rodrigo Masses Joining Synergi Partners Puerto Rico An Industry Leader In Hiring Credits And Tax Incentives Synergi Partners

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Will Statehood Benefit Puerto Rico Puerto Rico 51st

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Cares Act A Lifeboat For Puerto Rico Insights Dla Piper Global Law Firm